Income Tax Filing Services

A tax return is defined as a form or different types of forms filed with a taxing authority which reports income, expenses, and other pertinent tax information. Tax returns make it simple for taxpayers to calculate their tax liability, schedule tax payments and request refunds for the overpayment of taxes. All taxpayers who are filing their income tax returns are required to determine the type of income tax return (ITR) form they need to fill before actually filing their returns. The form to be filled is solely dependent on the income that the taxpayer earns, or in certain cases if the taxpayer holds assets in a country other than India or earns any form of income from a country other than India.

Get a Quote

Salaried people get Form 16 which gives information of salary earned and advance taxes paid. Besides the basic salary there are other components being benefits which are wholly or partially taxable. Further, there are tax saving options like eligible investments under SEC 80C , donations made etc.

You are required to provide Form-16 and Form-26AS (mandatory) to get a Expert assigned on your order. We request to provide these documents within 24hours of plan purchase to help us assign a Expert and file your returns on time.

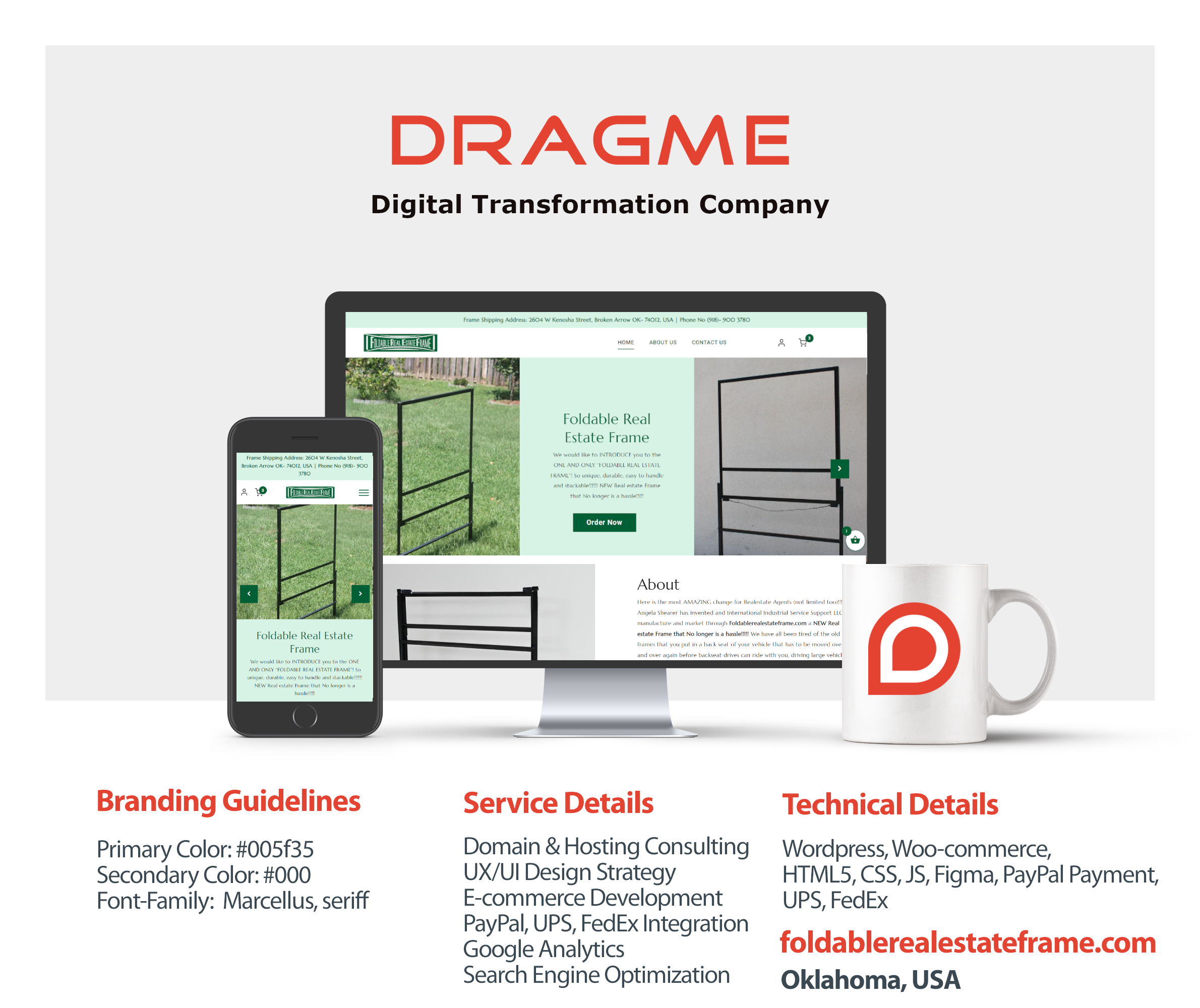

Our Portfolios

Ruvi Sri Pure & Natural, Tamil Nadu, India

Ruvi Sri Pure & Natural, Tamil Nadu, India Foldable Real Estate Frame, Oklahoma, USA

Foldable Real Estate Frame, Oklahoma, USA

Let's Innovate Together

Our support team is always ready to help. Give us a call, drop us an email, or just fill in the form below to instantly schedule a call with us.

About Us

DRAGME is a leading digital transformation company in web development. We are passionate in building your business into the form of creative websites. We would love to help you in the growth of your business in the form of creativity, digital transformation and story telling.Read More

Services

Copyright © 2024 DRAGME. All rights reserved.